“It is proposed to amend the Tax Code and consider half of the reporting year as the reporting period for the calculation and payment of real estate tax for organizations, and make the payment for the 1st semester up to and including June 1 of the tax year, and for the 2nd semester up to and including December 1 of the tax year. As a result of the legislative amendments, it is expected that the level of planning and implementation of the revenue part of the community budget will improve, as well as the efficiency of targeted use will increase,” the RA Deputy Minister of Territorial Administration and Infrastructure Vache Terteryan noted.

The Deputy Minister also informed that each reporting year is considered a reporting period for the calculation of the real estate tax for individuals. Individuals will continue to pay real estate taxes once a year.

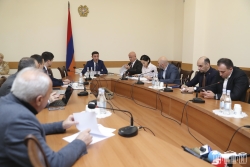

On December 5, the draft law on Amending the RA Tax Code was debated in the first reading at the extraordinary sitting of the NA Standing Committee on Economic Affairs and endorsed. It will be included in the draft agenda of the current NA session.

08.08.2024

08.08.2024Alen Simonyan is on a working visit in Vayots Dzor Marz

The working visit of the RA NA President Alen Simonyan to Vayots Dzor Marz/province started from the Noravank Monastic Complex, where the Primate of the Diocese His Eminence Archbishop Abraham Mkrtchyan met the NA President.After that Alen Simonyan visited Jermuk, met with the local residents, after...